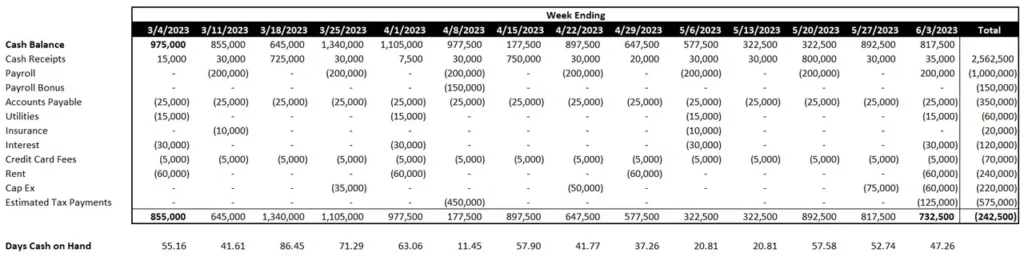

So far, we've talked about a lot of great things. And most recently, we focused on cash and the importance of forecasting (fore-cash-ting). We talked about how a 13-Week Rolling Cash Forecast is a phenomenal tool that can be leveraged to help manage liquidity expectations. But, a rolling cash forecast? How do you build it?

It's actually pretty straightforward, and can even be completed by hand. It's a conservative estimate of your cash position, what cash you expect to collect, and what cash you expect to send out. Depending on how complex (multiple entities and bank accounts with multiple payroll cycles) or straightforward (one payroll cycle) your organization is, will determine whether your forecast needs to be by day or by week. For simplicity's sake, let's say it's by week.

1. Start with Your Current Cash Balance

2. Add Projected Cash Collections

- What is owed to you?

- What do you anticipate selling?

- And when will it all be collected?

Using a combination of historical trending, current run rate, and sales forecast with cash collections tempered by customer terms and historical timing of collections.

3. Subtract Projected Cash Outflows

- What do you owe others?

- What additional expenses do you anticipate paying?

- And when will it all be paid?

Using a combination of historical trending, current run rate, and budgeted expenses tempered by vendor terms, bonus payments, and capital expenditures.

4. Review and Analyze

- How does it look?

- Do you have anticipated shortfalls?

- Surpluses?

- Will we need to borrow monies to shore up liquidity?

- Is there an opportunity to renegotiate vendor or customer terms?

- Or, do we have an opportunity to invest a potential excess?

5. Update and Adjust

- Update each week, incorporating actuals and extending the forecast another week.

- Compare prior week's estimate to actuals.

- Do we have any notable differences?

- Are they related to timing, or are they an unexpected result of operations?

- Action accordingly.

6. Review with Key Stakeholders

- Share with applicable parties, including investors, lenders, and other key business partners.

And, there you have it. A 13-Week Rolling Cash Forecast. I know it does take a bit of effort to keep up, but the insights it provides into your business's financial health are invaluable. And, remember, Cash is King.